The likely impact of President-elect Donald Trump’s upcoming term on the share market has gathered different analyses from the world of finance gurus.

Here are some key insights and metrics:

1. Earnings Growth Projections

• S&P 500 Companies: Experts forecasts a 12% increase in profits for S&P 500 companies, marking the biggest year-on-year profits since late 2021. This is slightly lower from previous predictions of 14.5%.

2. Sector-Specific Impacts

• Electric Vehicles (EVs): Concerns have arisen about the potential loss of federal purchase incentives worth up to $7,500 for EVs under Trump’s administration. This could relatively increase prices for manufacturers like Tesla. Despite these concerns, investors remain optimistic about Tesla’s future, expecting the administration to support the development and launch of self-driving cars.

• Energy Sector: New U.S. sanctions on Russian oil producers are expected to push oil prices higher, affecting global markets. U.S. crude oil prices have reached their highest since August.

3. Market Volatility Indicators

• VIX Index: The VIX ‘fear index’ has risen to 22, its highest since election day, indicating increased market volatility.

4. Cryptocurrency Outlook

• Bitcoin: Analysts predict that the price of Bitcoin could surge to $250,000 in 2025, driven by expectations of favorable cryptocurrency policies from the incoming Trump administration. The creation of a strategic national reserve for Bitcoin and a more lenient regulatory framework are expected to drive demand and mainstream adoption.

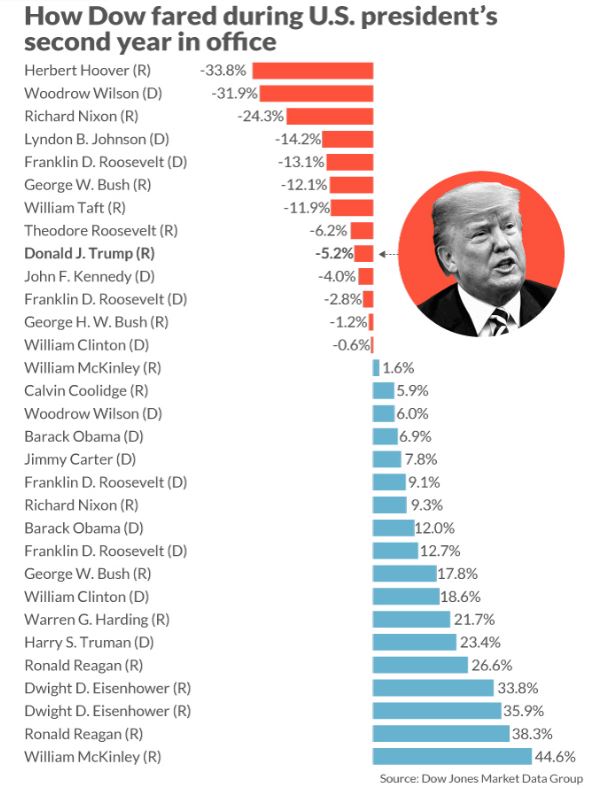

5. Historical Comparisons

• Previous Term Performance: During Trump’s first term, the Dow Jones Industrial Average surged 34.8%, the S&P 500 ascended 25%, and the Nasdaq leapt 32.9% by the end of 2017. Analysts are evaluating whether similar growth patterns will emerge in the upcoming term.

6. Investor Sentiment

• Market Rally: The post-election stock rally has slowed, with the Dow Jones Industrial Average and the Russell 2000 index experiencing declines. Investors are hoping the upcoming earnings season will rejuvenate the market.

In summary, while there is optimism regarding certain sectors and overall earnings growth, concerns about policy changes and market volatility persist. Investors are advised to monitor upcoming policy announcements and economic indicators closely to assess the potential impact on their portfolios.